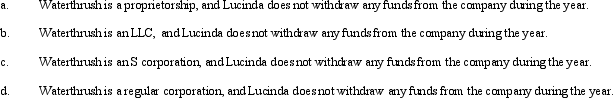

During the current year,Waterthrush Company had operating income of $510,000 and operating expenses of $400,000.In addition,Waterthrush had a long-term capital gain of $30,000.How does Lucinda,the sole owner of Waterthrush Company,report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Q61: What is a limited liability company? What

Q65: Which of the following statements is correct

Q82: Red Corporation, a C corporation that has

Q86: Schedule M-1 of Form 1120 is used

Q93: Warbler Corporation,an accrual method regular corporation,was formed

Q95: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q97: Canary Corporation,an accrual method C corporation,uses the

Q99: On December 28,2012,the board of directors of

Q100: Amber Company has $400,000 in net income

Q129: Briefly describe the accounting methods available for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents