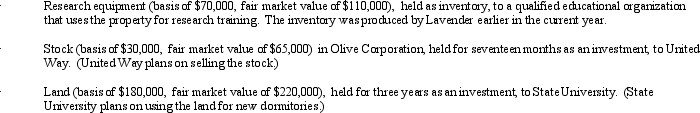

During the current year,Lavender Corporation,a C corporation in the business of manufacturing tangible research equipment,made charitable contributions to qualified organizations as follows:

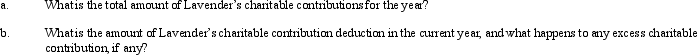

Lavender Corporation's taxable income (before any charitable contribution deduction)is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction)is $2.5 million.

Correct Answer:

Verified

Q42: During the current year, Thrasher, Inc., a

Q62: Eagle Corporation owns stock in Hawk Corporation

Q64: Erin Corporation, a personal service corporation, had

Q69: Schedule M-1 of Form 1120 is used

Q76: George Judson is the sole shareholder and

Q80: Robin Corporation, a calendar year C corporation,

Q81: During the current year,Coyote Corporation (a calendar

Q84: Ostrich,a C corporation,has a net short-term capital

Q85: Tonya,an actuary,is the sole shareholder of Shrike

Q86: Compare the basic tax and nontax factors

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents