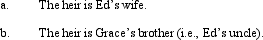

In April 2011,Ed gives his mother,Grace,real estate (basis of $400,000;fair market value of $800,000).Ed paid no Federal gift tax on the transfer.Before Grace's death in March 2012,she makes $30,000 in capital improvements to the property.The real estate is worth $820,000 when Grace dies.What is the income tax basis of the property to Grace's heir under each of the following assumptions?

Correct Answer:

Verified

Q97: Which, if any, of the following items

Q102: Art makes a gift of stock in

Q103: Barney creates a trust,income payable to Chloe

Q104: In each of the following independent situations,describe

Q105: At the time of her death in

Q106: Fred and Pearl always have lived in

Q109: After a prolonged illness,Claire has been diagnosed

Q110: In February 2011,Taylor sold real estate (adjusted

Q111: Bob and Paige are married and live

Q112: Andrew makes a gift of securities (basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents