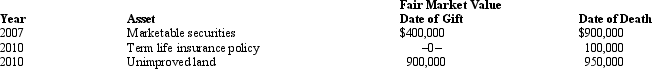

Prior to his death in 2012,Alma made the following gifts.  As a result of the 2010 transfer,Alma paid a gift tax of $70,000.As to these transactions,Alma's gross estate includes:

As a result of the 2010 transfer,Alma paid a gift tax of $70,000.As to these transactions,Alma's gross estate includes:

A) $0.

B) $70,000.

C) $100,000.

D) $170,000.

E) $1,120,000.

Correct Answer:

Verified

Q90: Which, if any, of the following statements

Q95: In which, if any, of the following

Q105: Which,if any,of the following items is subject

Q106: Stacey inherits unimproved land (fair market value

Q108: Andrea dies on April 30,2012.Which,if any,of the

Q109: Mark dies on March 6,2012.Which,if any,of the

Q111: At the time of his death,Jason was

Q113: At the time of his death,Trent owned

Q114: At the time of her death on

Q119: Which, if any, of the following is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents