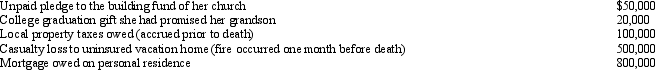

At the time of her death in 2012,Amber owns property worth $5,000,000.Other information regarding her affairs is as follows.

All of these items (except the casualty loss)were paid by her estate and none were deducted on Form 1041 (income tax return of the estate).What is Amber's taxable estate?

All of these items (except the casualty loss)were paid by her estate and none were deducted on Form 1041 (income tax return of the estate).What is Amber's taxable estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: In contrasting the computation of the Federal

Q128: The IRS does not consider property settlements

Q152: Joint tenancies and tenancies by the entirety

Q154: At the time of Clint's death in

Q155: In 1992,Noah and Olivia acquire realty for

Q156: Murray owns an insurance policy on the

Q157: In 2000,Dale and Andrea acquire real estate

Q160: Distributions from retirement plans and proceeds from

Q161: For estate tax purposes,what is the difference

Q162: Generally,property that passes to a surviving spouse

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents