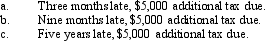

Quon filed his Federal income tax return on time,but he did not remit the full balance due.Compute Quon's failure to pay penalty in each of the following cases.The IRS has not yet issued a deficiency notice.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Marco, a cash basis, calendar year taxpayer,

Q107: Compute the failure to pay and failure

Q112: A tax preparer can incur a penalty

Q121: Margaurite did not pay her Federal income

Q123: Yin-Li is the preparer of the Form

Q126: Compute the overvaluation penalty for each of

Q127: Compute the undervaluation penalty for each of

Q129: Bettie,a calendar year individual taxpayer,files her 2011

Q153: The Treasury issues "private letter rulings" and

Q156: A tax professional needs to know how

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents