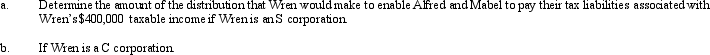

Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%.Wren's taxable income for 2012 is $400,000.

Correct Answer:

Verified

Q103: List some techniques which can be used

Q106: Swallow,Inc. ,is going to make a distribution

Q107: Daisy,Inc. ,has taxable income of $850,000 during

Q108: Kirk is establishing a business in 2012

Q108: Pelican, Inc., a C corporation, distributes $275,000

Q109: Ralph owns all the stock of Silver,Inc.

Q112: What is the major pitfall associated with

Q112: Colin and Reed formed a business entity

Q113: Ashley has a 65% interest in a

Q114: Lee owns all the stock of Vireo,Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents