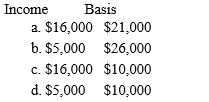

In the current year,Darlene purchases a 20% interest in the Grant Partnership (GP)for $10,000.During the current year,GP has a taxable income of $80,000 and Darlene withdraws $5,000 of cash from the partnership.Darlene's income to be reported from her investment in GP and her basis in GP at the end of the year is:

Correct Answer:

Verified

Q27: Some discontented taxpayers have suggested that complexity

Q28: No income is taxed until the taxpayer

Q29: Carter sold 100 shares of Mitsui, Inc.

Q30: Which of the following concepts/doctrines state(s) that

Q31: The allowance of deductions in calculating taxable

Q33: Which of the following is/are based on

Q36: During the current year, Walter invests $35,000

Q37: Which of the following is a taxable

Q38: According to the entity concept

I.each unit must

Q39: Sanchez Company allows its employees to make

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents