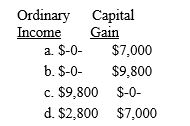

On October 23,2016,McIntyre sells 700 shares of stock at $26 per share.McIntyre acquired the stock on June 1,2015,when he exercised his option to purchase the shares through his company's incentive stock option plan.The exercise price was $12 per share and the fair market value of the stock at the date of exercise was $16 per share.For 2016,McIntyre must report

Correct Answer:

Verified

Q61: When calculating AMTI,individual taxpayers must add back

Q62: To obtain the rehabilitation expenditures tax credit

Q63: To obtain the rehabilitation expenditures tax credit

Q64: Dunn Company bought an old building in

Q64: An exemption amount is allowed for the

Q69: Ortiz Corporation determined its AMTI to be

Q70: Kelly purchases a warehouse for her sole

Q75: With regard to the alternative minimum tax

Q86: For the current year, Steven's tentative alternative

Q98: Which of the following is (are)AMT tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents