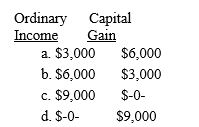

On October 2,2016,Miriam sells 1,000 shares of stock at $20 per share.Miriam acquired the stock on November 12,2015,when she exercised her option to purchase the shares through her company's incentive stock option plan.The exercise price was $11 per share and the fair market value of the stock at the date of exercise was $14 per share.For 2016,Miriam must report

Correct Answer:

Verified

Q64: When calculating AMTI, individual taxpayers must add

Q65: Which of the following statements are correct

Q68: When calculating AMTI,individual taxpayers must add back

Q73: Which of the following is (are) AMT

Q74: Hillside Group,a partnership,purchased a building for $60,000

Q77: Which of the following credits can not

Q83: Match each statement with the correct term

Q90: A U.S.formed multinational corporation

I.Can avoid the payment

Q100: Sylvester is a U.S. citizen living in

Q107: Drew is a partner with Peyton LLP.Peyton

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents