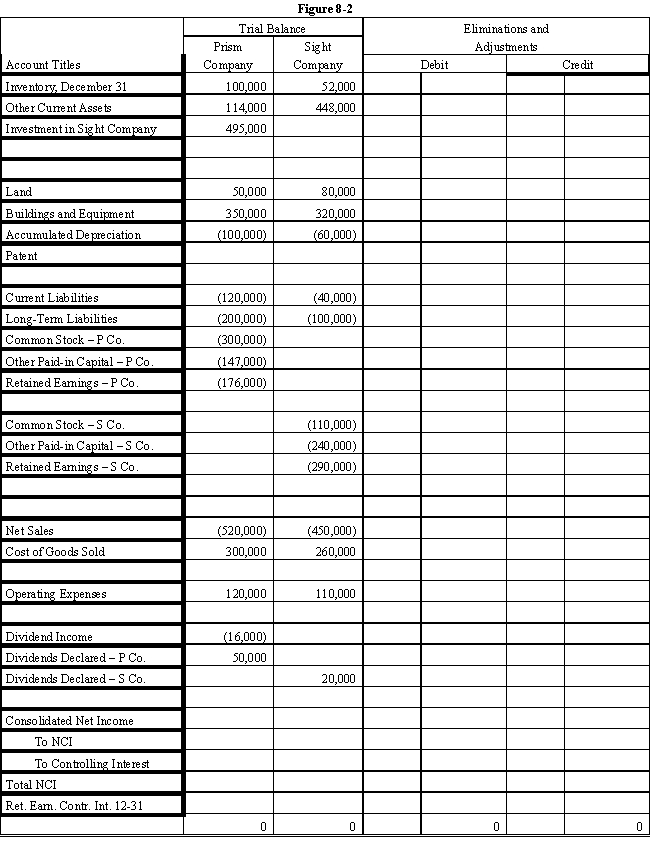

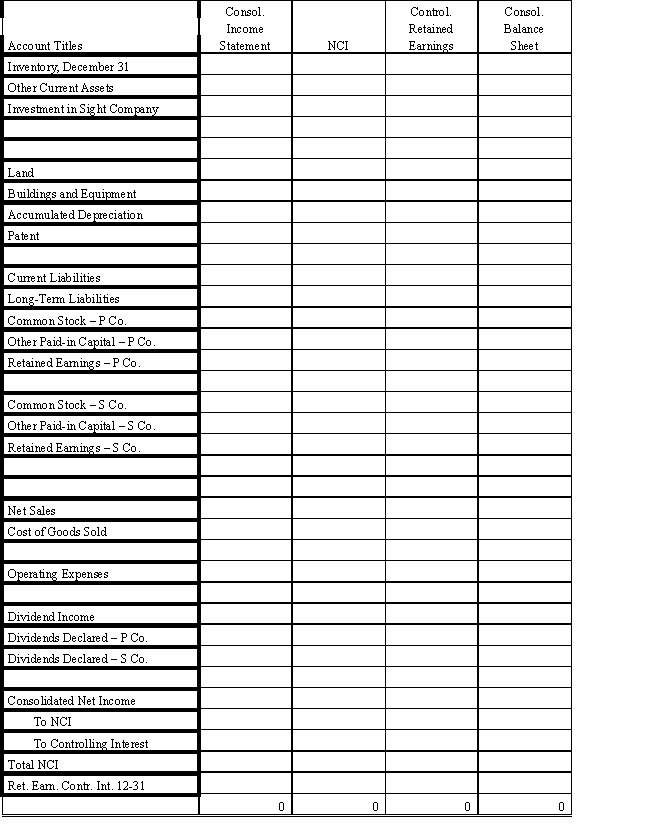

On January 1, 2016, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000.On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $200,000 and $300,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight using the cost method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-2 worksheet for consolidated financial statements for 2017.

?

?

?

?

Correct Answer:

Verified

?

?

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: When a subsidiary issues a stock dividend,

Q31: On January 1, 2016, Parent Company purchased

Q32: On January 1, 2016, Parent Company

Q33: Plum Inc.acquired 90% of the capital stock

Q34: a.What would be Company P's investment balance

Q36: Plum Inc.acquired 90% of the capital stock

Q37: On January 1, 2016, Prism Company

Q38: On January 1, 2016, Parent Company purchased

Q39: On January 1, 2016, Parent Company purchased

Q40: When a subsidiary purchases shares of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents