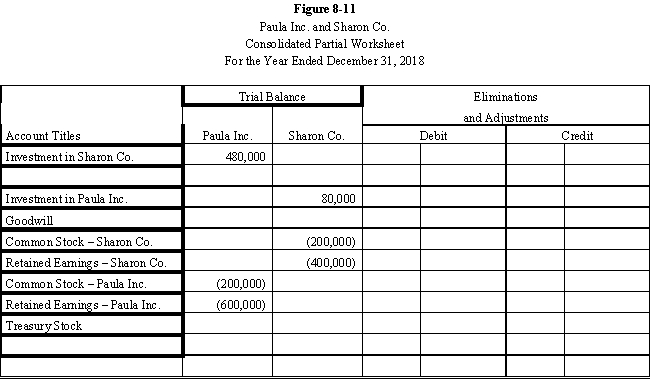

Paula Inc.purchased an 80% interest in the Sharon Co.for $480,000 on January 1, 2016, when Sharon Co.had the following stockholders' equity:

?

?

Any excess is attributable to goodwill.

?

On January 1, 2018, Sharon Co.purchased a 10% interest in the Paula Inc.at a price equal to book value.Both firms maintain investments under the cost method.

?

Required:

?

a.Complete the Figure 8-11 partial worksheet for December 31, 2018, assuming the use of the treasury stock method.?

?

b.Calculate the distribution of income for 2018, assuming that internally generated net income is $50,000 for Paula and $20,000 for Sharon.?

?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Manke Company owns a 90% interest in

Q25: On January 1, 2016, Parent Company

Q26: On 1/1/16 Poncho acquired an 80%

Q27: Parrot, Inc.purchased a 60% interest in

Q28: When a subsidiary owns shares of the

Q30: When a subsidiary issues a stock dividend,

Q31: On January 1, 2016, Parent Company purchased

Q32: On January 1, 2016, Parent Company

Q33: Plum Inc.acquired 90% of the capital stock

Q34: a.What would be Company P's investment balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents