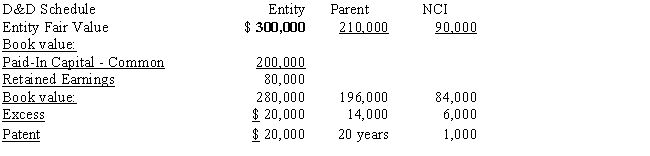

Company P Industries purchased a 70% interest in Company S on January 1, 2016, and prepared the following determination and distribution of excess schedule:

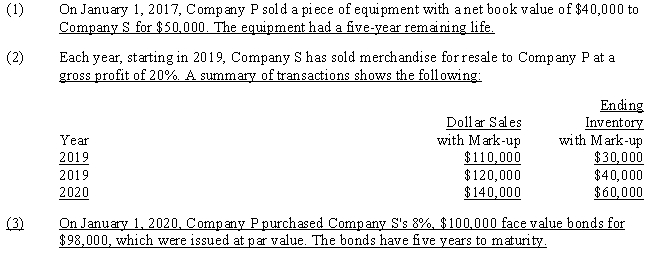

Since the purchase, there have been the following intercompany transactions:

Since the purchase, there have been the following intercompany transactions:

Required:

Required:

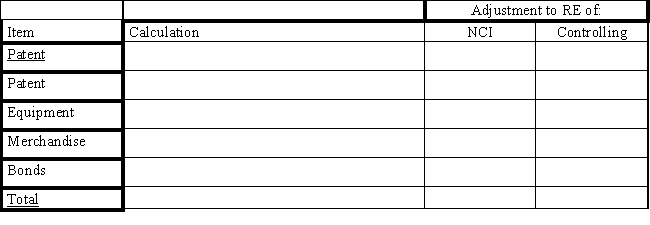

Complete the following schedule to adjust the retained earnings of the non-controlling and controlling interest on the December 31, 2020, worksheet for a consolidated balance sheet only.Company P uses the simple equity method to account for its investment.

Correct Answer:

Verified

Q32: On January 1, 2016, Patrick Company

Q33: Saddle Corporation is an 80%-owned subsidiary of

Q34: Pepin Company owns 75% of Savin Corp.Savin's

Q35: Company P has consistently sold merchandise

Q36: On January 1, 2016, Poplar Company acquired

Q37: Which of the following is not true

Q38: Company P owns a 90% interest in

Q39: Parent Company owns an 80% interest in

Q41: A subsidiary company may have preferred stock

Q42: It is common for a parent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents