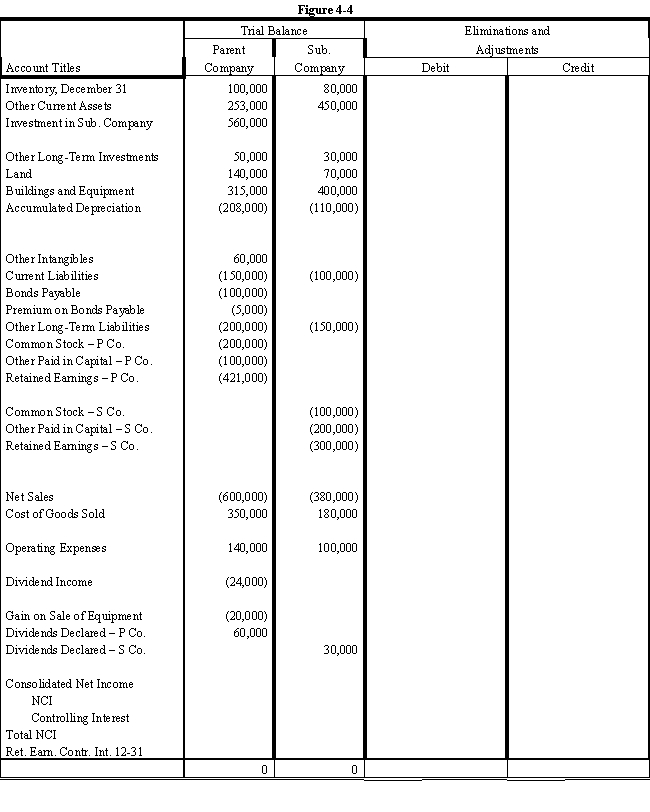

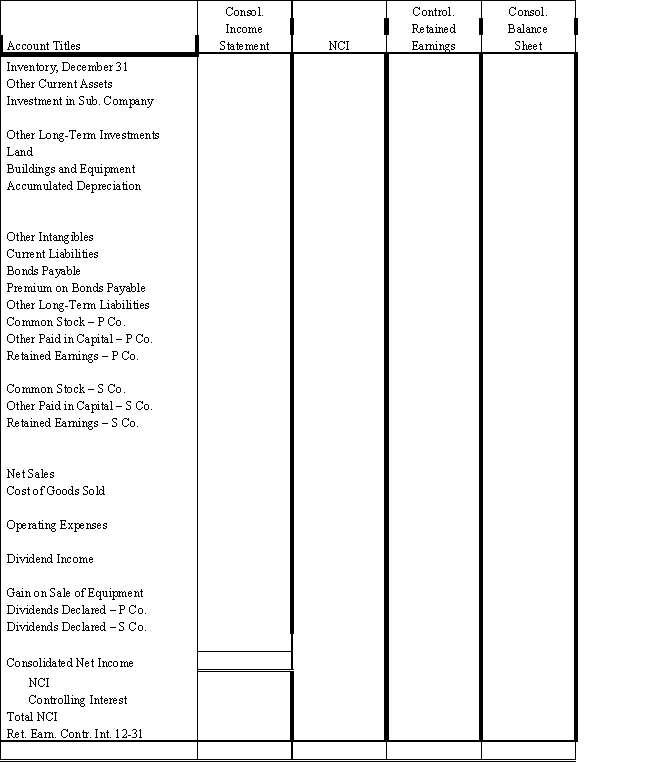

On January 1, 2016, Parent Company acquired 80% of the common stock of Subsidiary Company for $560,000.On this date Subsidiary had total owners' equity of $540,000, including retained earnings of $240,000.During 2016, Subsidiary had net income of $60,000 and paid no dividends.

?

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

?

During 2016 and 2017, Parent has appropriately accounted for its investment in Subsidiary using the cost method.

?

On January 1, 2017, Parent held merchandise acquired from Subsidiary for $10,000.During 2017, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 2017.Subsidiary's usual gross profit on affiliated sales is 40%.

?

On December 31, 2017, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

?

On January 1, 2017, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000.The sales price was $40,000.Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

?

Required:

?

Complete the Figure 4-4 worksheet for consolidated financial statements for the year ended December 31, 2017.

?

?

?

?

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Account balances are as of December 31,

Q32: The following accounts were noted in reviewing

Q33: On January 1, 2016, Prange Company acquired

Q34: Patti Corp.has several subsidiaries (Aeta, Beta,

Q35: Company P owns 100% of the

Q37: If subsidiary net income is $15,000 for

Q38: Selected information from the separate and

Q39: On January 1, 2016, Parent Company acquired

Q40: On January 1, 2016, Pinto Company

Q41: On January 1, 2016, Powers Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents