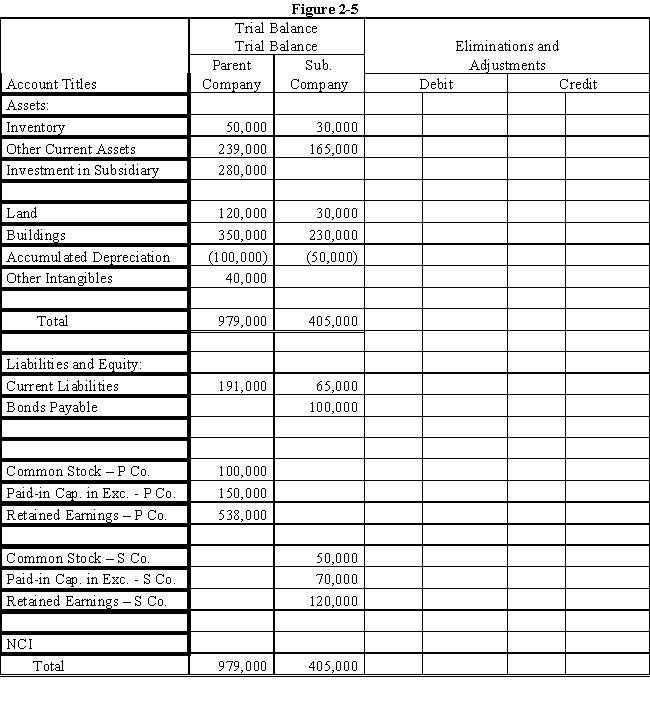

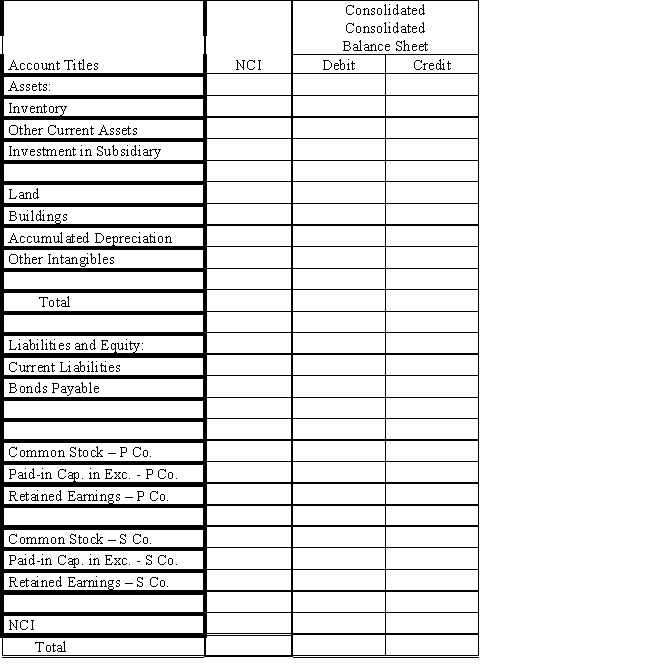

On January 1, 2016, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000.On this date, Subsidiary had total owners' equity of $240,000.

?

On January 1, 2016, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment.The fair value of land is $50,000.The fair value of building and equipment is $200,000.The book value of the land is $30,000.The book value of the building and equipment is $180,000.

?

Required:

?

a.Using the information above and on the separate worksheet, complete a value analysis schedule

?

?

b.Complete schedule for determination and distribution of the excess of cost over book value.?

?

c.Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 2016.?

?

?

?

Correct Answer:

Verified

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Pinehollow acquired 70% of the outstanding

Q23: On January 1, 2016, Parent Company purchased

Q24: How is the non-controlling interest treated in

Q25: On December 31, 2016, Priority Company

Q26: Pinehollow acquired 80% of the outstanding

Q28: The SEC requires the use of push-down

Q29: Pesto Company paid $8 per share to

Q30: Supernova Company had the following summarized

Q31: Supernova Company had the following summarized balance

Q32: Supernova Company had the following summarized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents