Fortuna Company issued 70,000 shares of $1 par stock, with a fair value of $20 per share, for 80% of the outstanding shares of Acappella Company.The firms had the following separate balance sheets prior to the acquisition:

?

?

Book values equal fair values for the assets and liabilities of Acappella Company, except for the property, plant, and equipment, which has a fair value of $1,600,000.

?

Required:

?

a.Prepare a value analysis schedule

?

?

b.Prepare a determination and distribution of excess schedule.?

?

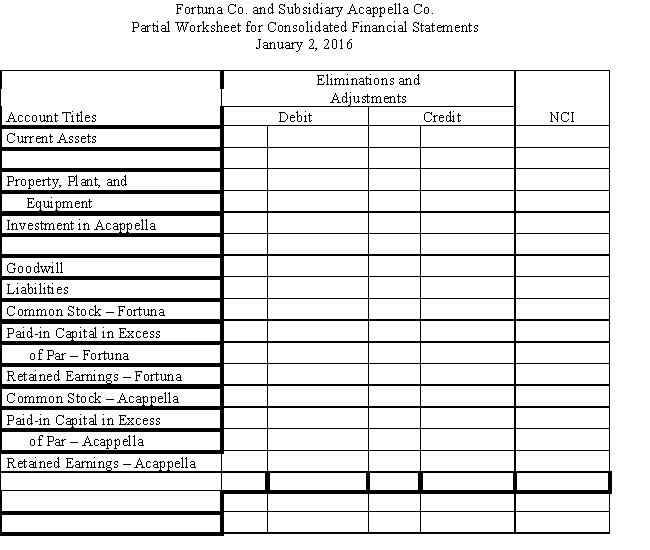

c.Provide all eliminations on the partial balance sheet worksheet provided in Figure 2-9 and complete the non-controlling interest column.?

Figure 2-9

Fortuna Co.and Subsidiary Acappella Co.Partial Worksheet for Consolidated Financial Statements

January 2, 2016

?

?

?

?

Balance Sheet

?

Account Titles

Fortuna

Acappella

Current Assets

2,100,000

960,000

?

?

?

Property, Plant, and

?

?

Equipment

4,600,000

1,300,000

Investment in Acappella

1,400,000

?

?

?

?

Goodwill

?

240,000

Liabilities

(3,000,000)

(800,000)

Common Stock - Fortuna

(870,000)

?

Paid-in Capital in Excess

?

?

of Par - Fortuna

(3,530,000)

?

Retained Earnings - Fortuna

(700,000)

?

Common Stock - Acappella

?

(200,000)

Paid-in Capital in Excess

?

?

of Par - Acappella

?

(300,000)

Retained Earnings - Acappella

?

(1,200,000)

?

?

?

?

?

?

?

?

?

?

?

?

?

Correct Answer:

Verified

a. Value analysis schedule:

*Cannot be...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Consolidated financial statements are appropriate even without

Q17: Pagach Company purchased 100% of the

Q18: When it purchased Sutton, Inc.on January

Q19: An investor records its share of its

Q20: When it purchased Sutton, Inc.on January

Q22: Pinehollow acquired 70% of the outstanding

Q23: On January 1, 2016, Parent Company purchased

Q24: How is the non-controlling interest treated in

Q25: On December 31, 2016, Priority Company

Q26: Pinehollow acquired 80% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents