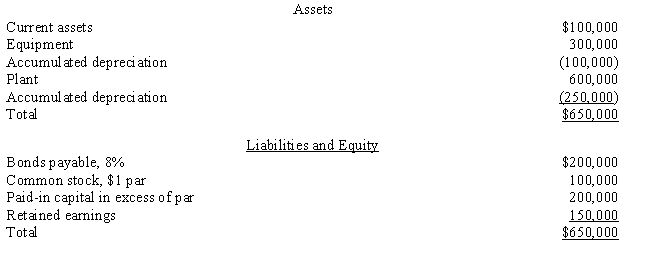

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash.The balance sheet for the Don Company on the date of acquisition showed the following:

?

?

Required:

Required:

?

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000.Assume that the Chan Corporation has an effective tax rate of 40%.Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

?

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.?

?

b.The bonds have a current fair value of $190,000.The transaction is a taxable exchange.?

?

c.There are $100,000 of prior-year losses that can be used to claim a tax refund.The transaction is a taxable exchange.?

?

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due.The transaction is a taxable exchange.?

Correct Answer:

Verified

a.

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Internet Corporation is considering the acquisition

Q39: Which of the following income factors should

Q40: ACME Co.paid $110,000 for the net

Q41: Diamond acquired Heart's net assets.At the

Q42: Poplar Corp.acquires the net assets of

Q43: Goodwill is an intangible asset.There are a

Q44: The Blue Reef Company purchased the

Q45: While acquisitions are often friendly, there are

Q47: On January 1, 2016 the fair

Q48: On January 1, July 1, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents