Company A holds 70 percent of the voting shares of Company B. During 20X8, Company B sold land with a book value of $125,000 to Company A for $150,000. Company A continues to hold the land at the end of the year. The companies file separate tax returns and are subject to a 40 percent tax rate. Assume that Company A uses the fully adjusted equity method in accounting for its investment in Company B.

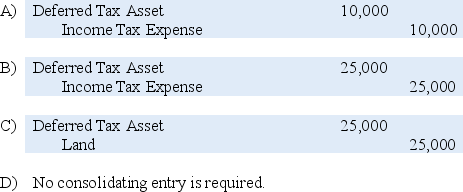

-Based on the information given,which consolidating entry relating to the intercorporate sale of land is to be entered in the consolidation worksheet prepared at the end of 20X8?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q13: Sigma Company develops and markets organic food

Q14: Plywood Corporation's consolidated cash flow statement for

Q17: Pure Life Corporation has just finished preparing

Q19: Which sections of the cash flow statement

Q21: Denver Corporation owns 25 percent of the

Q26: Peacoat Corporation acquired 80 percent of Sweater

Q26: Denver Corporation owns 25 percent of the

Q27: Ceafoam Corporation acquired 80 percent of Trump

Q29: Pony Corporation acquired 90 percent of Saddle

Q40: Peacoat Corporation acquired 80 percent of Sweater

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents