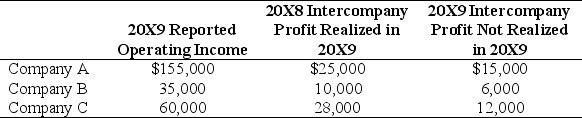

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock. All acquisitions were made at book value. The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies. The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000. Each company is involved in a number of intercompany inventory transfers each period. Information on the companies' activities for 20X9 is as follows:

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

-Based on the information provided,what amount of income tax expense should be assigned to Company A?

A) $72,000

B) $66,000

C) $112,000

D) $62,000

Correct Answer:

Verified

Q41: Plush Corporation holds 80 percent of Scratch

Q41: Company A holds 70 percent of the

Q43: On December 31,20X7,Planet Corporation acquired 80 percent

Q44: Company A holds 70 percent of the

Q45: Power Corporation owns 75 percent of Transmitter

Q47: Company A owns 85 percent of Company

Q48: Locus Corporation acquired 80 percent ownership of

Q49: Pain Corporation holds 90 percent of Soothing

Q50: For the first quarter of 20X8,Vinyl Corporation

Q51: Locus Corporation acquired 80 percent ownership of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents