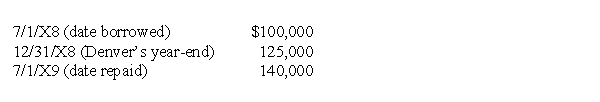

On November 1,20X8,Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest-bearing note due on November 1,20X9,which is denominated in the currency of the lender.The U.S.dollar equivalent of the note principal was as follows:  In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

Correct Answer:

Verified

Q21: Myway Company sold equipment to a Canadian

Q22: Myway Company sold equipment to a Canadian

Q23: On November 6,20X7,Zucor Corp.purchased merchandise from an

Q26: Spartan Company purchased interior decoration material from

Q28: Robert Company sold inventory to an Australian

Q32: On September 1,20X1,Bain Corp.received an order for

Q32: Robert Company sold inventory to an Australian

Q33: Sphinx Co.(Sphinx)records its transactions in U.S.dollars.A sale

Q37: Taste Bits Inc. purchased chocolates from Switzerland

Q38: On September 22,20X1,Yumi Corp.purchased merchandise from an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents