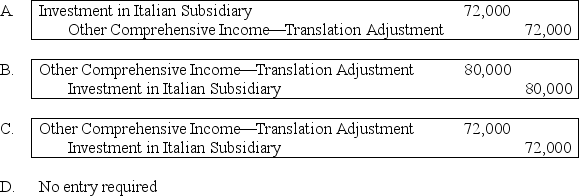

Dover Company owns 90% of the capital stock of a foreign subsidiary located in Italy.Dover's accountant has just translated the accounts of the foreign subsidiary and determined that a debit translation adjustment of $80,000 exists.If Dover uses the fully adjusted equity method for its investment,what entry should Dover record in order to recognize the translation adjustment?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q23: Park Co.'s wholly-owned subsidiary,Schnell Corp. ,maintains its

Q33: If the functional currency is the local

Q34: For each of the items listed below,state

Q35: On January 2, 20X8, Johnson Company acquired

Q37: On September 30, 20X8, Wilfred Company sold

Q39: The Canadian subsidiary of a U.S.company reported

Q40: On January 2, 20X8, Johnson Company acquired

Q42: Mercury Company is a subsidiary of Neptune

Q43: On January 2, 20X8, Johnson Company acquired

Q53: On January 1,20X8,Pullman Corporation acquired 75 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents