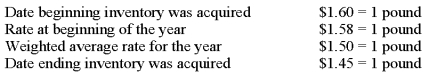

The British subsidiary of a U.S.company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31.The beginning inventory was 10,000 pounds,and the ending inventory was 15,000 pounds.Spot rates for various dates are as follows:  Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

A) $108,750.

B) $112,500.

C) $114,300.

D) $125,700.

Correct Answer:

Verified

Q25: The assets listed below of a foreign

Q26: On September 30, 20X8, Wilfred Company sold

Q27: Parent Company's wholly-owned subsidiary,Son Corporation,maintains its accounting

Q28: Which combination of accounts and exchange rates

Q31: Seattle,Inc.owns an 80 percent interest in a

Q32: If the functional currency is the local

Q33: If the functional currency is the local

Q34: For each of the items listed below,state

Q35: On January 2, 20X8, Johnson Company acquired

Q37: On October 15,20X1,Planet Company sold inventory to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents