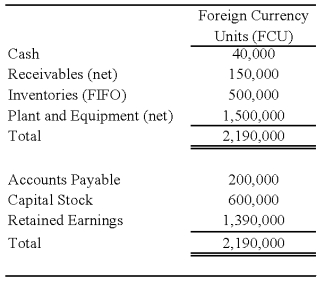

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

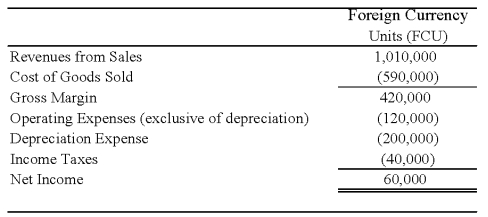

Perth's income statement for 20X8 is as follows:

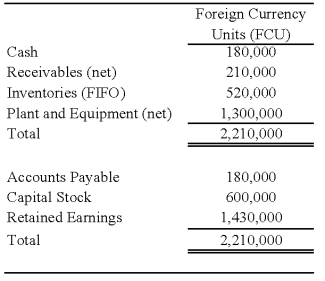

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

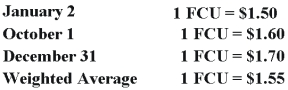

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2,20X8.Round your answer to the nearest dollar.

A) $11,500

B) $11,884

C) $7,667

D) $9,394

Correct Answer:

Verified

Q13: The balance in Newsprint Corp.'s foreign exchange

Q16: All of the following describe the International

Q18: Dividends of a foreign subsidiary are translated

Q19: Infinity Corporation acquired 80 percent of the

Q20: Which of the following defines a foreign-based

Q22: On September 30, 20X8, Wilfred Company sold

Q25: The assets listed below of a foreign

Q26: On September 30, 20X8, Wilfred Company sold

Q39: On October 15,20X1,Planet Company sold inventory to

Q40: On October 15,20X1,Planet Company sold inventory to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents