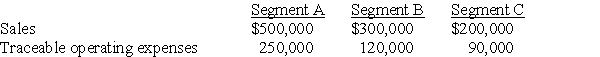

Tuttle Company discloses supplementary operating segment information for its three reportable segments.Data for 20X3 are available as follows:

Allocable costs for the year were $54,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X3 operating profit for Segment A was

A) $196,000

B) $223,000

C) $225,000

D) $250,000

Correct Answer:

Verified

Q4: Operand Corporation reported consolidated revenues of $30,000,000

Q5: The following information pertains to revenue earned

Q7: Tuttle Company discloses supplementary operating segment information

Q7: An analysis of Abbey Company's operating segments

Q8: Trevor Company discloses supplementary operating segment information

Q9: An analysis of Abbey Company's operating segments

Q10: Dragon Company has two reportable segments,A and

Q13: Zeus Corporation has determined that it has

Q13: Trimester Corporation's revenue for the year ended

Q14: Main Manufacturing Corporation reported consolidated revenues of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents