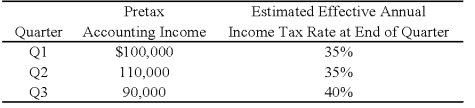

William Corporation,which has a fiscal year ending January 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended January 31,20X8:  William's income tax expenses in its interim income statement for the third quarter are:

William's income tax expenses in its interim income statement for the third quarter are:

A) $36,000.

B) $73,500.

C) $46,500.

D) $120,000.

Correct Answer:

Verified

Q6: Five of eight internally reported operating segments

Q14: In 20X6 and 20X7,each of Putney Company's

Q16: Crisfield Company has two reportable segments,C and

Q17: Trevor Company discloses supplementary operating segment information

Q20: Biometric Corporation's revenue for the year ended

Q21: Assume that the replacement did not happen

Q22: Tecumseh Co.(Tecumseh),a publicly owned corporation,assesses performance and

Q23: Wakefield Company uses a perpetual inventory system.In

Q24: Reportable segments are not required to disclose

Q25: ASC 280 requires certain disclosures about major

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents