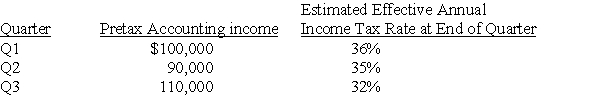

Daniel Corporation,which has a fiscal year ending December 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended December 31,20X6:

Daniel's income tax expense in its interim income statement for the third quarter is

A) $29,500

B) $35,200

C) $66,500

D) $96,000

Correct Answer:

Verified

Q30: Which of the following characteristics would render

Q31: Stone Company reported $100,000,000 of revenues on

Q32: Wakefield Company uses a perpetual inventory system.In

Q33: Grum Corp.,a publicly-owned corporation,is subject to the

Q34: The following information pertains to Aria Co.(Aria)and

Q36: Wakefield Company uses a perpetual inventory system.In

Q36: Collins Company reported consolidated revenue of $120,000,000

Q38: The key to reporting accounting information by

Q39: Which of the following are established by

Q40: Cherokee Company reported consolidated revenue of $90,000,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents