In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following questions is independent of the others.

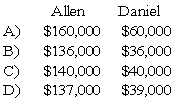

-Refer to the information provided above.David invests $40,000 for a one-fifth interest in the total capital of $220,000.What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q25: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q26: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q30: In the AD partnership,Allen's capital is $140,000

Q32: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q47: A partner's tax basis in a partnership

Q53: In the JK partnership, Jacob's capital is

Q55: In the AD partnership, Allen's capital is

Q55: In the JK partnership,Jacob's capital is $140,000,and

Q60: In the AD partnership,Allen's capital is $140,000

Q67: Apple and Betty are planning on beginning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents