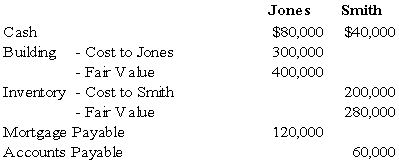

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

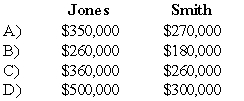

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q47: A partner's tax basis in a partnership

Q54: In the JK partnership,Jacob's capital is $140,000,and

Q61: A joint venture may be organized as

Q62: The ABC partnership had net income of

Q64: Which of the following observations is true

Q64: Miller and Davis,partners in a consulting business,share

Q66: In the JAW partnership,Jane's capital is $100,000,Anne's

Q69: If A is the total capital of

Q71: Paul and Ray sell musical instruments through

Q72: Two sole proprietors,L and M,agreed to form

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents