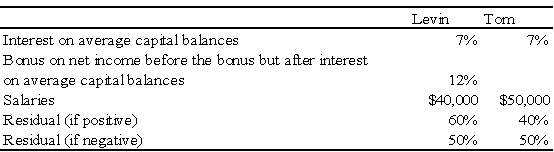

Net income for Levin-Tom partnership for 2009 was $125,000.Levin and Tom have agreed to distribute partnership net income according to the following plan:

Additional Information for 2009 follows:

1.Levin began the year with a capital balance of $75,000.

2.Tom began the year with a capital balance of $100,000.

3.On March 1,Levin invested an additional $25,000 into the partnership.

4.On October 1,Tom invested an additional $20,000 into the partnership.

5.Throughout 2009,each partner withdrew $200 per week in anticipation of partnership net income.The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a.Prepare a schedule that discloses the distribution of partnership net income for 2009.Show supporting computations in good form.

b.Prepare the statement of partners' capital at December 31,2009.

c.How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Problem 73 (continued):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: In the JK partnership,Jacob's capital is $140,000,and

Q62: The ABC partnership had net income of

Q67: Jones and Smith formed a partnership with

Q69: If A is the total capital of

Q71: Paul and Ray sell musical instruments through

Q72: Two sole proprietors,L and M,agreed to form

Q74: James Dixon,a partner in an accounting firm,decided

Q75: Jones and Smith formed a partnership with

Q76: The PQ partnership has the following plan

Q77: On June 30,the balance sheet for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents