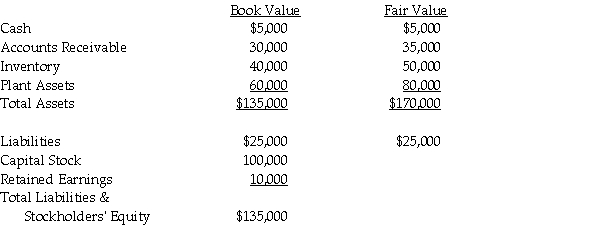

On January 1, 2011, Jeff Company acquired a 90% interest in Margaret Company for $198,000 cash.On January 1, 2011, Margaret Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.

a.Record the journal entry on Margaret's separate books on January 1, 2011.

b.Record the journal entry on Jeff's separate books on January 1, 2011.

2.Assume both companies use the parent company theory.

a.Record the journal entry on Margaret's separate books on January 1, 2011.

b.Record the journal entry on Jeff's separate books on January 1, 2011.

Correct Answer:

Verified

Q4: Assume Paris's inventory account had a book

Q6: A parent company acquired 100% of the

Q22: With regard to a variable interest entity

Q22: Use the following information to answer the

Q26: Patch Corporation has a 50% undivided interest

Q28: On January 1,2011,Parton Corporation acquired an 80%

Q28: Partel Corporation purchased 75% of Sandford Corporation

Q29: Use the following information to answer the

Q29: Johnsen Corporation paid $225,000 for a 70%

Q39: On July 1,2010,Parslow Corporation acquired a 75%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents