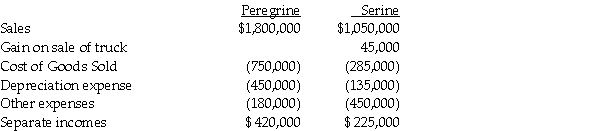

Peregrine Corporation acquired an 80% interest in Serine Corporation in 2009 at a time when Serine's book values and fair values were equal to one another.On January 1, 2012, Serine sold a truck with a $55,000 book value to Peregrine for $100,000.Peregrine is depreciating the truck over 10 years using the straight-line method.The truck has no salvage value.Separate incomes for Peregrine and Serine for 2012 were as follows:  Peregrine's investment income from Serine for 2012 was

Peregrine's investment income from Serine for 2012 was

A) $108,000.

B) $144,000.

C) $147,600.

D) $180,000.

Correct Answer:

Verified

Q1: Use the following information to answer the

Q2: Use the following information to answer the

Q4: Pied Imperial Corporation acquired a 90% interest

Q5: On January 1,2012 Saffron Co.recorded a $40,000

Q9: Plenny Corporation sold equipment to its 90%-owned

Q9: Use the following information to answer the

Q10: Use the following information to answer the

Q11: On January 1, 2011, Bigg Corporation sold

Q14: Use the following information to answer the

Q16: Parrot Corporation acquired a 70% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents