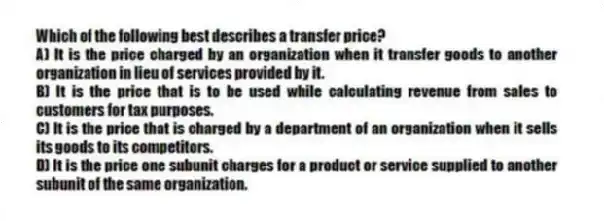

Which of the following best describes a transfer price?

A) It is the price charged by an organization when it transfer goods to another organization in lieu of services provided by it.

B) It is the price that is to be used while calculating revenue from sales to customers for tax purposes.

C) It is the price that is charged by a department of an organization when it sells its goods to its competitors.

D) It is the price one subunit charges for a product or service supplied to another subunit of the same organization.

Correct Answer:

Verified

Q53: The president of Silicon Company has just

Q54: Negotiated transfer prices are often employed when

Q55: Axelia Corporation has two divisions, Refining and

Q56: The transfer price creates revenues for the

Q57: Axelia Corporation has two divisions, Refining and

Q59: The product or service transferred between subunits

Q60: What is decentralization and what are its

Q61: Negotiated transfer prices are often employed when

Q62: Branded Shoe Company manufactures only one type

Q63: Branded Shoe Company manufactures only one type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents