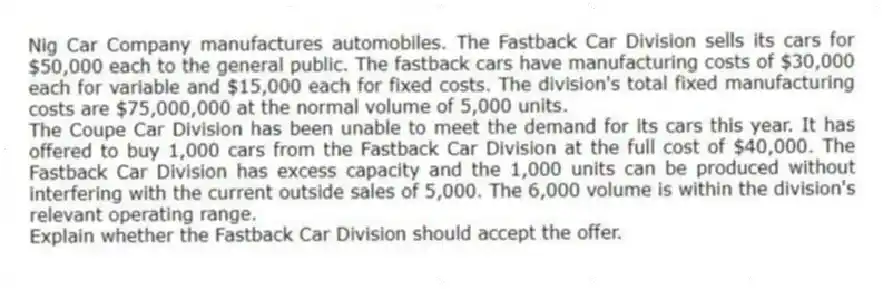

Nig Car Company manufactures automobiles. The Fastback Car Division sells its cars for $50,000 each to the general public. The fastback cars have manufacturing costs of $30,000 each for variable and $15,000 each for fixed costs. The division's total fixed manufacturing costs are $75,000,000 at the normal volume of 5,000 units.

The Coupe Car Division has been unable to meet the demand for its cars this year. It has offered to buy 1,000 cars from the Fastback Car Division at the full cost of $40,000. The Fastback Car Division has excess capacity and the 1,000 units can be produced without interfering with the current outside sales of 5,000. The 6,000 volume is within the division's relevant operating range.

Explain whether the Fastback Car Division should accept the offer.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: Sandra's Sheet Metal Company has two divisions.

Q98: When an industry has excess capacity, market

Q99: Olive Branch Company recently acquired an olive

Q100: Briefly explain each of the three methods

Q101: A company should use cost-based transfer prices

Q103: Crush Company makes internal transfers at 155%

Q104: An advantage of a negotiated transfer price

Q105: Super Shoes Company manufactures sneakers. The Athletic

Q106: The full cost plus a markup transfer-pricing

Q107: When using transfer prices based on costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents