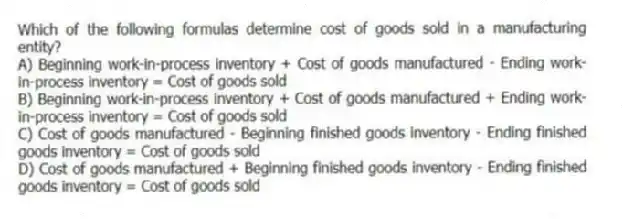

Which of the following formulas determine cost of goods sold in a manufacturing entity?

A) Beginning work-in-process inventory + Cost of goods manufactured - Ending work-in-process inventory = Cost of goods sold

B) Beginning work-in-process inventory + Cost of goods manufactured + Ending work-in-process inventory = Cost of goods sold

C) Cost of goods manufactured - Beginning finished goods inventory - Ending finished goods inventory = Cost of goods sold

D) Cost of goods manufactured + Beginning finished goods inventory - Ending finished goods inventory = Cost of goods sold

Correct Answer:

Verified

Q157: All costs reported on the income statement

Q158: Expert Manufacturing reported the following: Q159: Banks provide services or what some might Q160: Howard Manufacturing Company had the following account Q161: Cost of goods sold for a manufacturer Q163: Each of the following items pertains to Q164: Expert Manufacturing reported the following: Q165: All Rite Manufacturing reported the following: Q166: A company reported revenues of $377,000, cost Q167: Conversion costs include _.![]()

![]()

A) direct materials and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents