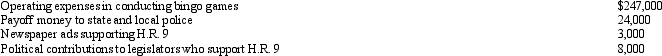

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2011,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2011,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Q64: Which of the following cannot be deducted

Q66: Benita incurred a business expense on December

Q67: Which of the following is incorrect?

A) Alimony

Q68: Agnes is the sole shareholder of Violet,Inc.For

Q69: Vera is the CEO of Brunettes,a publicly

Q69: Payments by a cash basis taxpayer of

Q71: Tom operates an illegal drug-running operation and

Q73: Gerald owns an illegal casino.Which of the

Q74: Tommy, an automobile mechanic employed by an

Q75: Iris,a calendar year cash basis taxpayer,owns and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents