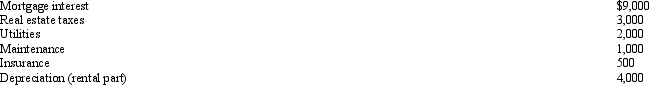

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:  Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Q82: Because Scott is three months delinquent on

Q83: In January, Lance sold stock with a

Q84: For an activity classified as a hobby,

Q94: Which of the following is not a

Q95: Arnold and Beth file a joint return.Use

Q96: Melanie incurred the following expenses for her

Q97: Which of the following is not deductible?

A)Moving

Q100: Velma and Josh divorced.Velma's attorney fee of

Q101: Emelie and Taylor are employed by the

Q102: Marvin spends the following amounts on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents