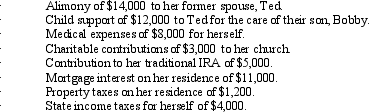

Amy incurs and pays the following expenses during the year:

Amy's only income is a $100,000 salary.Calculate Amy's deductions for AGI and from AGI.

Amy's only income is a $100,000 salary.Calculate Amy's deductions for AGI and from AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Which of the following is relevant in

Q82: Because Scott is three months delinquent on

Q86: Cory incurred and paid the following expenses:

Q87: If a vacation home is determined to

Q88: Ruth and Jeff own an unincorporated hardware

Q89: On January 2,2011,Fran acquires a business from

Q91: Priscella pursued a hobby of making bedspreads

Q94: Which of the following is not a

Q95: Arnold and Beth file a joint return.Use

Q97: Which of the following is not deductible?

A)Moving

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents