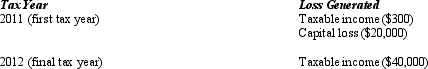

The Yan Estate is your client,as are many of the decedent's family members.Determine the tax effects of the indicated losses for the Yan Estate for both tax years.The estate holds a variety of investment assets,which it received from the decedent,Mrs.Yan.The estate's sole income and remainder beneficiary is Yan,Jr.

Correct Answer:

Verified

Q121: In computing Federal taxable income, can the

Q122: The Gibson Estate is responsible for the

Q124: The Leonardo Estate operates a business and

Q127: An estate has $100,000 DNI,composed of $50,000

Q142: List the three major functions of distributable

Q145: When the Holloway Trust terminated this year,

Q147: Tax professionals use the terms simple trust

Q149: When a fiduciary distributes to a beneficiary

Q150: How is entity accounting income computed? What

Q151: Identify the parties that are present when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents