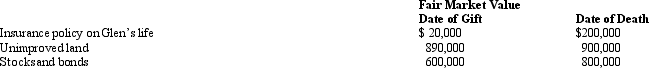

In 2009,Glen transferred several assets by gift to different persons.Glen dies in 2011.Information regarding the properties given is summarized below.  The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Glen's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Glen's gross estate must include:

A) $0.

B) $200,000.

C) $260,000.

D) $1,900,000.

E) $1,960,000.

Correct Answer:

Verified

Q90: Which, if any, of the following statements

Q95: In which, if any, of the following

Q104: Andrea dies on April 30, 2011. Which,

Q105: In which of the following situations has

Q115: In which,if any,of the following independent situations

Q116: Mark dies on March 3, 2011. Which,

Q118: Prior to his death in 2011,Alma made

Q119: Which, if any, of the following is

Q119: At the time of his death,Norton was

Q126: Regarding the transfer tax credits available, which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents