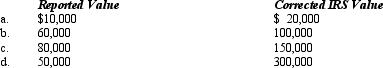

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Correct Answer:

Verified

Q103: To file for a tax refund, an

Q118: Compute the failure to pay and failure

Q120: Maria's AGI last year was $195,000. To

Q121: Compute the overvaluation penalty for each of

Q127: Loren Ltd.,a calendar year taxpayer,had the following

Q128: Clara underpaid her taxes by $50,000.Of this

Q138: When a tax dispute is resolved, interest

Q144: Congress has set very high goals as

Q151: If a taxpayer is audited by the

Q169: A taxpayer penalty may be waived if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents