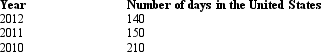

Given the following information,determine whether Greta,an alien,is a U.S.resident for 2012.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Assuming all sales are made to unrelated

Q125: The § 367 cross-border transfer rules seem

Q127: Which of the following statements regarding the

Q133: USCo, a domestic corporation, receives $100,000 of

Q141: BrazilCo,Inc.,a foreign corporation with a U.S.trade or

Q145: Certain portfolio income items (i.e., foreign personal

Q146: Freiburg, Ltd., a foreign corporation, operates a

Q148: Match the definition with the correct term.

Q158: Arendt, Inc., a domestic corporation, purchases a

Q159: Present, Inc., a domestic corporation, owns 60%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents