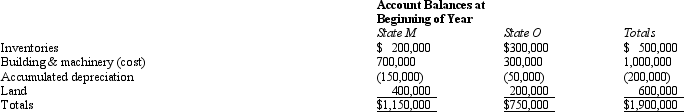

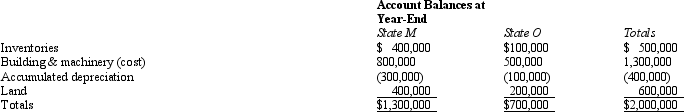

Valdez Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Valdez's O property factor is:

Valdez's O property factor is:

A) 35.0%.

B) 37.2%.

C) 39.5%.

D) 53.8%.

Correct Answer:

Verified

Q62: General Corporation is taxable in a number

Q65: Cruz Corporation owns manufacturing facilities in States

Q65: Britta Corporation's entire operations are located in

Q66: A use tax applies when a State

Q72: Net Corporation's sales office and manufacturing plant

Q74: Trayne Corporation's sales office and manufacturing plant

Q82: In the broadest application of the unitary

Q83: A taxpayer wishing to reduce the negative

Q84: A state sales tax usually falls upon:

A)

Q95: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents