Condor Corporation generated $450,000 of state taxable income from selling its product in States A and

B. Both states utilize a three-factor apportionment formula that equally weights sales, property, and payroll. The rates of corporate income tax imposed in A and B are 5% and 3%, respectively. Determine Condor's state income tax liability.

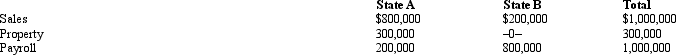

B. For the taxable year, the corporation's activities within the two states were as follows.

Condor has determined that it is subject to tax in both A and

Condor has determined that it is subject to tax in both A and

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Leased property, when included in the property

Q101: Almost all of the states treat a

Q106: A(n) _ business operates its separate companies

Q107: Several states allow the S corporation to

Q109: Overall tax liabilities typically (increase/decrease) if the

Q114: Compute Quail Corporation's State Q taxable income

Q115: In unitary states, a(n) _ provision permits

Q116: Milt Corporation owns and operates two facilities

Q130: Typically, a sales/use tax is applied to

Q131: A state sales/use tax is designed to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents