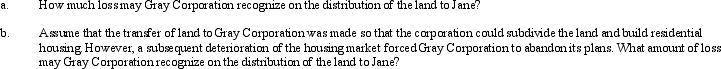

Mary and Jane,unrelated taxpayers,own Gray Corporation's stock equally.One year before the complete liquidation of Gray,Mary transfers land (basis of $420,000,fair market value of $350,000)to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $20,000 and fair market value of $95,000.In liquidation,Gray distributes the land to Jane.At the time of the liquidation,the land is worth $290,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The gain recognized by a shareholder in

Q17: For corporate reorganizations, the tax laws should

Q24: Purple Corporation has two equal shareholders, Joshua

Q45: All of the following statements are true

Q47: The stock of Tan Corporation (E &

Q55: Which of the following statements is true

Q80: Pursuant to a complete liquidation, Woodpecker Corporation

Q83: Penguin Corporation purchased bonds (basis of $95,000)

Q88: The stock of Brown Corporation (E &

Q94: Indigo has a basis of $1 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents