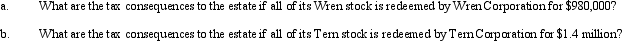

Sam's gross estate includes stock in Tern Corporation and Wren Corporation,valued at $1.4 million and $980,000,respectively.At the time of Sam's death in 2011,the stock represented 22% of Tern's outstanding stock and 27% of Wren's outstanding stock.Sam's adjusted gross estate equals $6,500,000.Death taxes and funeral and administration expenses for Sam's estate total $980,000.Sam had a basis of $350,000 in the Tern stock and $190,000 in the Wren stock at the time of his death.None of the beneficiaries of Sam's estate own (directly or indirectly)any stock in Tern Corporation,but some of the beneficiaries own stock of Wren Corporation.Consider the following independent questions.

Correct Answer:

Verified

Q96: The gross estate of Raul, decedent who

Q111: Thistle Corporation declares a nontaxable dividend payable

Q123: Hawk Corporation has 2,000 shares of stock

Q124: Ali is in the 35% tax bracket.He

Q129: Ivory Corporation (E & P of $650,000)has

Q144: Explain the requirements for waiving the family

Q145: What are the tax consequences of a

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q161: Explain the stock attribution rules that apply

Q183: When is a redemption to pay death

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents