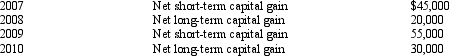

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2011.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 20117.

Compute the amount of Bear's capital loss carryover to 20117.

A) $0.

B) $60,000.

C) $105,000.

D) $165,000.

E) $200,000.

Correct Answer:

Verified

Q26: Schedule M-3 is similar to Schedule M-1

Q44: Juanita owns 45% of the stock in

Q48: Jade Corporation, a C corporation, had $100,000

Q51: Glen and Michael are equal partners in

Q52: Norma formed Hyacinth Enterprises, a proprietorship, in

Q54: On December 31,2011,Peregrine Corporation,an accrual method,calendar year

Q54: Flycatcher Corporation, a C corporation, has two

Q58: A corporation with $10 million or more

Q74: During 2011, Sparrow Corporation, a calendar year

Q79: Orange Corporation owns stock in White Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents