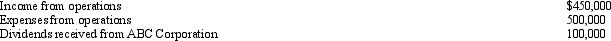

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Vireo Corporation, a calendar year C corporation,

Q89: Ostrich,a C corporation,has a net short-term capital

Q90: Beige Company has approximately $250,000 in net

Q90: Schedule M-1 of Form 1120 is used

Q91: On December 30,2011,the board of directors of

Q94: Warbler Corporation,an accrual method regular corporation,was formed

Q95: Compare the basic tax and nontax factors

Q105: Red Corporation, a C corporation that has

Q111: Nancy is a 40% shareholder and president

Q113: Shareholders of closely held C corporations frequently

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents