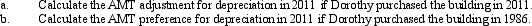

In September,Dorothy purchases a building for $900,000 to use in her business as a warehouse.Dorothy uses the depreciation method which will provide her with the greatest deduction for regular income tax purposes.

Correct Answer:

Verified

Q81: In calculating her taxable income,Rhonda deducts the

Q82: Bianca and Barney have the following for

Q83: Lavender,Inc.,incurs research and experimental expenditures of $210,000

Q84: In 2011,Louise incurs circulation expenses of $210,000

Q84: Which of the following statements is correct?

A)A

Q85: Luke's itemized deductions in calculating taxable income

Q87: Use the following data to calculate Marlene's

Q88: Kay,who is single,had taxable income of $0

Q90: Caroline and Clint are married,have no dependents,and

Q91: Smoke,Inc.,provides you with the following information:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents