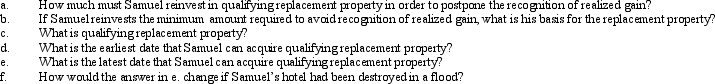

Samuel's hotel is condemned by the City Housing Authority on July 5,2011,for which he is paid condemnation proceeds of $950,000.He first received official notification of the pending condemnation on May 2,2011.Samuel's adjusted basis for the hotel is $600,000 and he uses a fiscal year for tax purposes with a September 30 tax year-end.

Correct Answer:

Verified

Q18: Elbert gives stock worth $28,000 (no gift

Q19: Renee purchases taxable bonds with a face

Q20: Teresa inherits land from her first cousin,Drew,in

Q22: Use the following data to determine the

Q24: Jake exchanges an airplane used in his

Q25: Justin owns 1,000 shares of Oriole Corporation

Q26: Sandy and Greta form Tan,Inc.by transferring the

Q27: For each of the following involuntary conversions,determine

Q28: Janet, age 68, sells her principal residence

Q28: Evelyn's office building is destroyed by fire

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents