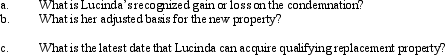

Lucinda,a calendar year taxpayer,owned a rental property with an adjusted basis of $215,000 in a major coastal city.When her property was condemned by the city government on November 5,2011,in order to build a convention center,Lucinda eventually received qualified replacement property from the city government on February 5,2012.This new property has a fair market value of $350,000.

Correct Answer:

Verified

Q30: On January 5,2011,Bill sells his principal residence

Q31: Don,who is single,sells his personal residence on

Q32: Eunice Jean exchanges land held for investment

Q33: Patty's factory building,which has an adjusted basis

Q35: a.Orange Corporation exchanges a warehouse located in

Q36: Rosa exchanges a truck used in her

Q37: Sidney exchanges equipment used in his business

Q38: Laura transfers her personal use automobile to

Q39: Katrina,age 58,rented (as a tenant)the house that

Q207: Monica sells a parcel of land to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents